Ocwen's servicing woes/ Expectations for Successors-in-Interest

- Apr 26, 2017

- 4 min read

Breaking down the major CFPB/20 State action against Ocwen and also looking at one interesting servicing issue in detail.

It's a mortgage servicing bananza today!

Ocwen Enforcement Action

Let's start with the Ocwen action:

Brought by the CFPB along with 20 other states, this has caused Ocwen's stock price to drop 55%. Ocwen is a major loan servicer, with a 1.4 million loan portfolio spread across 50 states.

I normally hate to copy long quotes, but here are some relevant parts of the CFPB's statements:

Today the [CFPB] is filing a lawsuit against Ocwen, one of the nation's largest nonbank mortgage servicers. We are seeking relief to compensate consumers for years of systemic and significant errors throughout the mortgage servicing process, which cost some of them their homes. We allege that Ocwen calculated loan balances improperly, misapplied borrower payments, and botched escrow and insurance payments. We believe Ocwen failed to properly investigate and fix these problems when people formally complained, and it illegally foreclosed on borrowers. And we believe Ocwen compounded these failures by selling the servicing rights to these loans without fully disclosing or correcting errors in people's records.... Among the infractions we allege in our complaint, Ocwen failed to credit payments made by borrowers and botched basic tasks related to managing escrow accounts. It also enrolled some borrowers in add-on products they did not request and did not want, then charged them anyway. It bungled payment of people's hazard insurance, pushing some into force-placed insurance. And it mishandled borrowers' private mortgage insurance, overcharging them in the process. Further, it has failed to properly handle communications with the heirs of troubled properties, such as widows or children trying to prevent foreclosure on a deceased relative's home. When borrowers made formal complaints, we believe Ocwen's investigations and responses were inadequate ...

Ocwen has long touted its ability to help struggling borrowers avoid foreclosure. But according to our complaint, Ocwen failed to give borrowers accurate information and foreclosure protections as required by law. As a result of these and other failures, we allege that Ocwen illegally initiated foreclosure proceedings and wrongfully conducted foreclosure sales, at times before even completing a review of borrowers' applications for help in saving their homes. We further assert that even when some borrowers were meeting their obligations under a loan modification agreement, such as making trial payments, Ocwen unilaterally broke the agreements and filed foreclosures on their homes.

Successors-in-Interest

Notice the one sentence above that is highlighted. Let's talk about that now.

It's an unfortunate reality, your mortgage borrower passes away and leaves someone behind who wants to live in/own the house. Can they afford the mortgage payment? Is there a chance this is just a scam? How do we protect the borrower's private information but also take care of this poor person who just lost a loved (presumably) one?

Get ready to be pulled in a dozen different directions. On one hand, we need to protect the deceased borrower's private information. But federal regulators (and human decency) want us to make it as easy as possible for successors-in-interest to handle the borrower's affairs. Another key concern is to promote home retention; to do everything possible to allowed loved ones to keep the home of a borrower who has passed away.

Three Considerations (Balancing Act)

Protecting private information from bad people (people trying to commit fraud)

Making it easy for a true successor-in-interest to get information

Doing enough to help the successor-in-interest stay in the home, such as by helping with loss mitigation options.

New CFPB Rules on Successors-in-Interest

Definition of "successor-in-interest"

Rule addressing How to confirm a successor-in-interest's identify and ownership interest

Extend same protections provided to the successor-in-interest as would have been provided to the original borrower.

"Successor-in-Interest": Defined

Since we can't focus on all the parts of the new rule, let's pick one of the three - defining who is, and is not, a successor-in-interest.

Rule: A successor-in-interest is someone who receives an ownership interest in a dwelling that secures a closed-end consumer loan because of:

(1) The death of a joint tenant or tenant by entirety

(2) The death of relative

(3) Any transfer where the spouse or children of the original borrower becomes owner

(4) A transfer resulting from divorce or legal separation agreement

(5) A transfer into an inter vivos trust where the original borrower remains a beneficiary

Simple enough, right? Well here are the key points of this definition:

No occupancy requirement -- someone who is not living in the dwelling can still be a successor

No borrower requirement -- someone who has not agreed to assume the loan can be a successor

Limited Parent-Child transfers -- The definition does not go so far as to provide successor-status to a child who receives property from a parent who is still alive.

In Other News

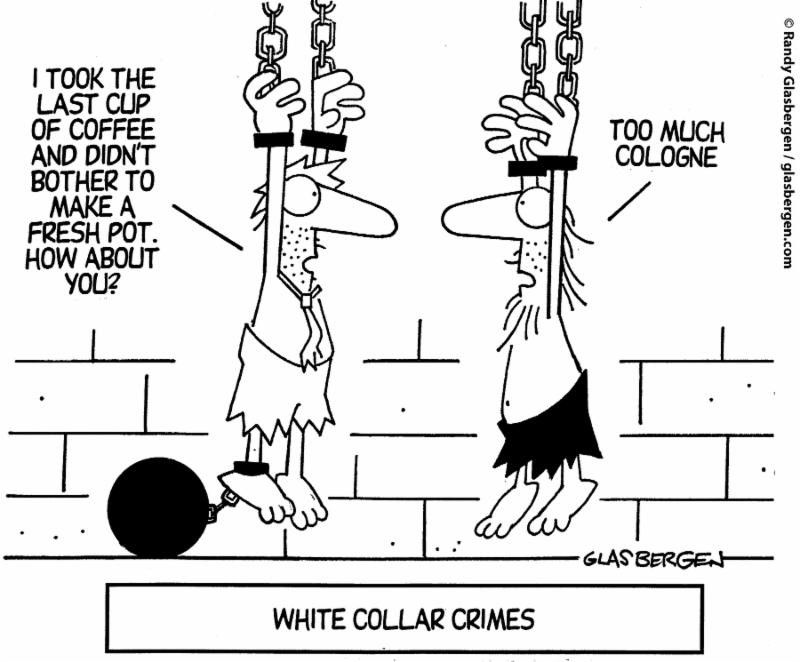

Intriguing turn-around-your-life story ... Former bank robber turns life around and lands job as a professor at Georgetown Law

Hey Gen X and Boomers will love this ... CNBC reports that more millennials live with a parent than with a spouse! Pretty embarrassing statistic for that generation.

On My Mind ...

What are the benefits of building trust? This is an excerpt from The Trust Edge by David Horsager:

I once worked for a man who was very talented and accomplished, but had trouble trusting his staff. The atmosphere around his office was tense, and nobody wanted to be the one to make a mistake that would draw his ire. We felt no freedom to act creatively, and the threat of failing to meet his demands was constant. As a result, productivity decreased and morale tanked. This is what happens when there are great expectations, but no trust. People crumble in this environment. When there is a lack of trust, everything costs more, takes more time, and creates more hassles. Extending trust inspires greater efficiency and effectiveness.

"The best way to predict the future is to create it."

- Peter Drucker

Thanks so much for reading our weekly newsletters. We're not always going to be perfect, but because we always do our best and try not to overpromise, we hope that we're always going to be trustworthy. Your calls and e-mails are very helpful - please keep contributing.

**These are our opinions. We're not authorized, or willing, to express those of others.**

Comments